More than fifty percent of American have less than $1000 in their savings account. Living paycheck to paycheck without a financial safety net is a stressful way to live, but it’s the reality for millions of modern adults Saving money and sticking to a smart budget is the best way to increase your financial security, but it can also be difficult and stressful in and of itself.

Especially if you already feel tight on money, scraping together any extra cash to put into long-term savings seems impossible. Contrary to popular belief, living within your means and having money left over from every paycheck doesn’t have to make you feel deprived. It is possible to get back on track financially without upending your lifestyle or making you feel more broke than you already do.

1. Save Whatever You Can

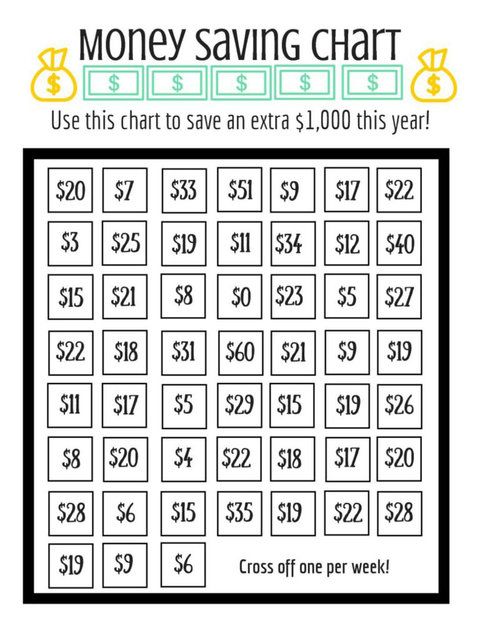

If you feel short on money, it’s easy to fall into a pattern of putting off saving anything until you feel more financially secure. This in turn leads to a habit of putting no money into savings for months or even years on end. Stop thinking of saving money as a huge, daunting investment. Saving money is a flexible expense; you get to choose exactly how much of your paycheck you put away long-term. That amount doesn’t have to be astronomical. Just make sure it’s not zero.

Depositing a small amount of money–even if it’s just $10 or $20–into your savings on a recurring weekly or monthly basis gets you in the habit of saving money and encourages you to save larger amounts whenever your income allows it. It also helps you start thinking of saving as a much less intimidating, more manageable concept that you can easily fit into your budget.

2. Round Up

What would you do if Starbucks charged an even $5.00 instead of $4.65 onto your debit card the next time you stop in for a grande latte? Chances are, you would never even notice the extra 35-cent charge.

That oversight is the basis of a new modern savings tactic–round up apps. These apps connect to your debit and/or credit cards and automatically siphon spare change from your purchases into a hold within the app. The average person using one of these apps saves about $30/month from round ups. While that might not seem like much, saving an extra $30 every month adds up. Plus, since you probably won’t notice the extra few cents leaving your accounts every day, you’ll end up with more than $300 in savings every year that you never even missed.

3. Start Investing

Investing your money gives it room to grow and discourages you from pulling money out of your savings too quickly.

You don’t have to put your money into a high-risk investment account. Any type of investment geared toward long-term savings stores your money slightly out of your reach to help you avoid temptation to spend and ideally leave you with more money than you put in within a few years. Most banks will let you set up a direct deposit as small as $50 a month to help you continue building your investment over time.

4. Track Your Spending

If someone asked you how much money you spent on subscriptions or at restaurants during the past month, you probably wouldn’t be able to give them a straight answer. Losing track of how you spend is very easy to do, but it’s also very dangerous for your budget. Awareness goes a long way when it comes to handling your money in a safe, smart way.

Tracking your spending forces you to be more aware of how you’re actually spending your money in any given day/week/month. Reminding yourself where your money is really going helps you identify problem areas in your budget and cut down on unnecessary spending that doesn’t actually any joy to your life. There are several easy ways to track your spending. Pay with cash instead of card,

5. Put Your Dollars in Their Place

Unnecessary spending is often a result of not organizing your money well enough. If you have an extra $50 sitting in your checking account and no concrete plan for how to spend it, it’s tempting to blow through it on something

Don’t wait to organize your money. As soon as you get your paycheck, transfer a certain amount of money into your permanent savings. Transfer another amount into an account that you can use to pay for essentials like bills, groceries, etc. Finally, keep a chunk of money in a checking account and let yourself spend that money on entertainment, going out, and other unnecessary expenses.

6. Personalize Your Plan

Pay attention to professional recommendations for budgeting, but don’t be afraid to personalize your budget to better fit your own life and priorities. Generally speaking, you should try to allocate half the money you make to necessities, thirty percent to non-essentials, and twenty percent to long-term savings.

Depending on your income and priorities, you can vary these percentages slightly to make sticking to your budget easier and more sustainable for you. Personalizing your budget allows you to be smart financially but keep spending some money on non-essentials that matter to you. Just make sure you keep general budgeting advice in mind to create a smart budget that will help save you money in the long run.

7. Stop Living Beyond Your Means

It’s very tempting–and common–to spend just a little bit more money than you make. You might not think an extra twenty bucks on your credit card matters much, but living beyond your means to any extent is a surefire way to destroy your budget and drain your savings.

The habit of spending more money than you earn can be really hard to break. However, there are ways to ease yourself back into living within your means. One of the most effective ways to cut back on spending you can’t actually afford is to stop charging things to credit. Credit cards make it way too easy to spend money you don’t have and worry about the consequences later. If you only pay for things with a debit card or–better yet–cash, you’ll be far less likely to make unnecessary impulse buys.

Budgeting and saving might seem daunting and restrictive at first. If you stick with it, though, making smarter financial decisions will help you feel much more financially secure and less broke in the long run.